The Reserve Bank of India on Friday (December 6) slashed the cash reserve ratio (CRR) by 50 basis points (bps) to 4% from 4.5% in a bid to boost liquidity in the financial system. CRR is the percentage of a bank’s total deposits that it is required to maintain in liquid cash with the RBI as a reserve. The Monetary Policy Committee (MPC) of the RBI, which met in Mumbai on Friday, however, kept the Repo rate – the key policy rate – unchanged at 6.5% in a majority 4-2 decision. This is the eleventh consecutive monetary policy, over 22 months, which has left the Repo rate unchanged. Significantly, the policy panel cut the GDP growth estimate to 6.6% in FY2025 from 7.2% projected earlier, and raised the retail inflation forecast to 4.8% for the current fiscal from 4.5% projected earlier. The six-member MPC also decided to retain the monetary policy stance as ‘neutral’ in the policy.

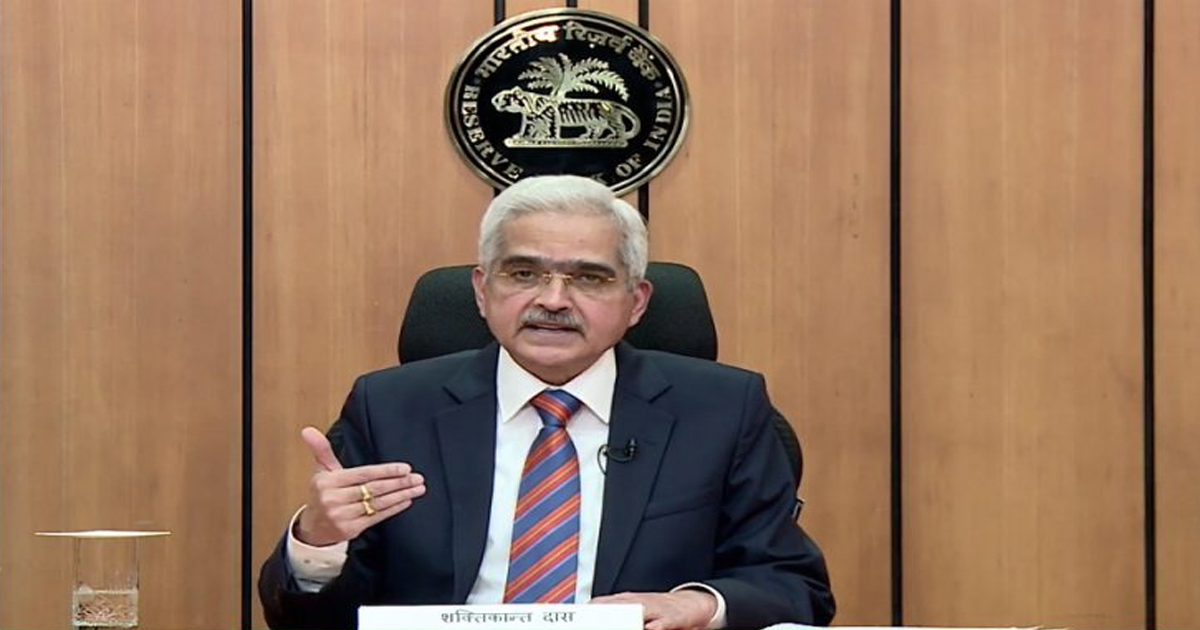

RBI keeps Repo rate unchanged